When you’re keeping your own books, it’s important to understand how to record both debits and credits.Īt its most basic, a debit is an entry on the left side of a ledger, indicating an increase in assets or a decrease in liabilities. How Do You Record Debit and Credit in Your Books? The goal is always to keep the accounting equation in balance. If you want to decrease your liabilities without also decreasing your assets, you need to find someone willing to invest in your business. If you want to increase your assets without also increasing your liabilities, you need to find someone willing to invest in your business (i.e., give you a credit against an outstanding invoice). For this reason, debits are sometimes referred to as “drawings” while credits are called “investments.”Īt the end of the day, it all comes down to simple math: whatever is not an asset must be a liability or equity. In other words, debits always reduce equity while credits always increase it.

The key difference between debits and credits lies in their effect on the accounting equation.Ī debit decreases assets or increases liabilities, while a credit increases assets or decreases liabilities. In accounting, there are two fundamental types of transactions: those that result in a decrease in assets or an increase in liabilities (debits) and those that result in an increase in assets or a decrease in liabilities (credits). What Is the Difference Between a Debit and a Credit? By understanding how debits and credits work, you can gain valuable insights into your business’s financial health. While debits and credits may seem confusing at first, they provide a valuable way of tracking financial transactions.

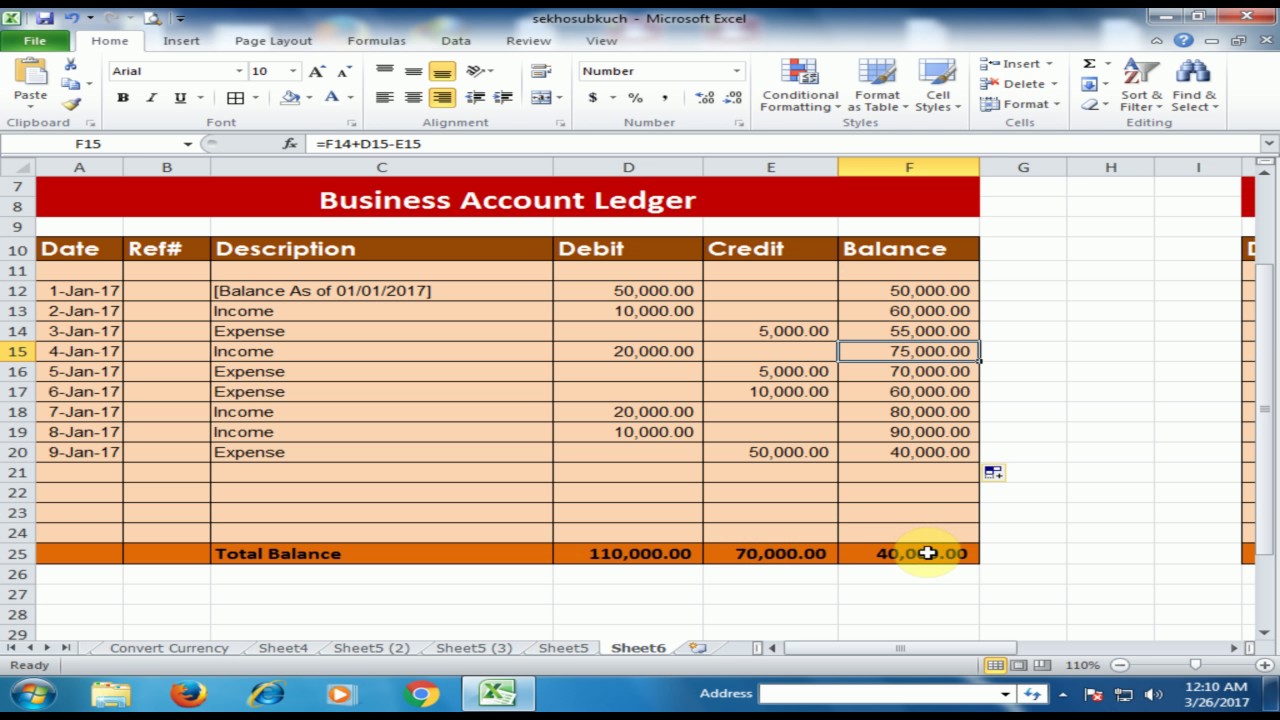

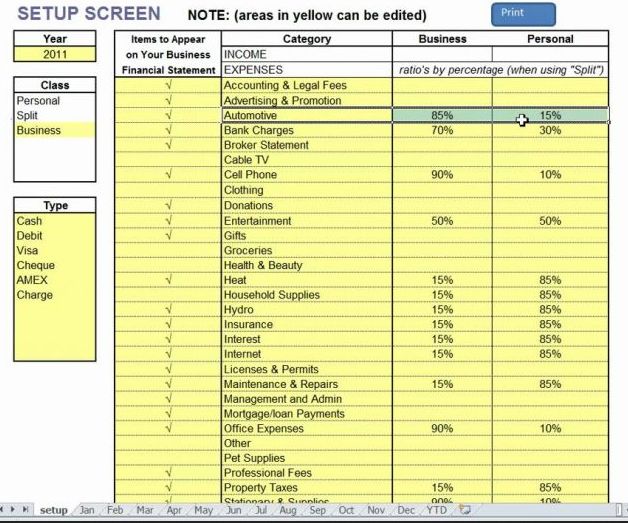

It helps you organize and index all your accounts and transactions, usually in a chart format. You also use a chart of accounts, that includes items like rent, utilities, payroll, and more. In double-entry bookkeeping, each financial transaction is recorded as both a debit and a credit.įor example, when a company purchase supplies on credit, the transaction would be recorded as a debit to the supplies account and a credit to the accounts receivable account. Debits and credits will increase and decrease account balances differently depending on the type of account, which we will look at more closely below. A debit is an entry on the left side of an account, while credit is an entry on the right side of an account. In accounting, debits and credits are used to record financial transactions. In this guide, we’ll go over the basics of bookkeeping-what accounts are debits and credits and how to record them in your books. Any difference between the totals on the right and left side means that there is an error in the books that should be investigated. It also acts as a proof sheet for the books.

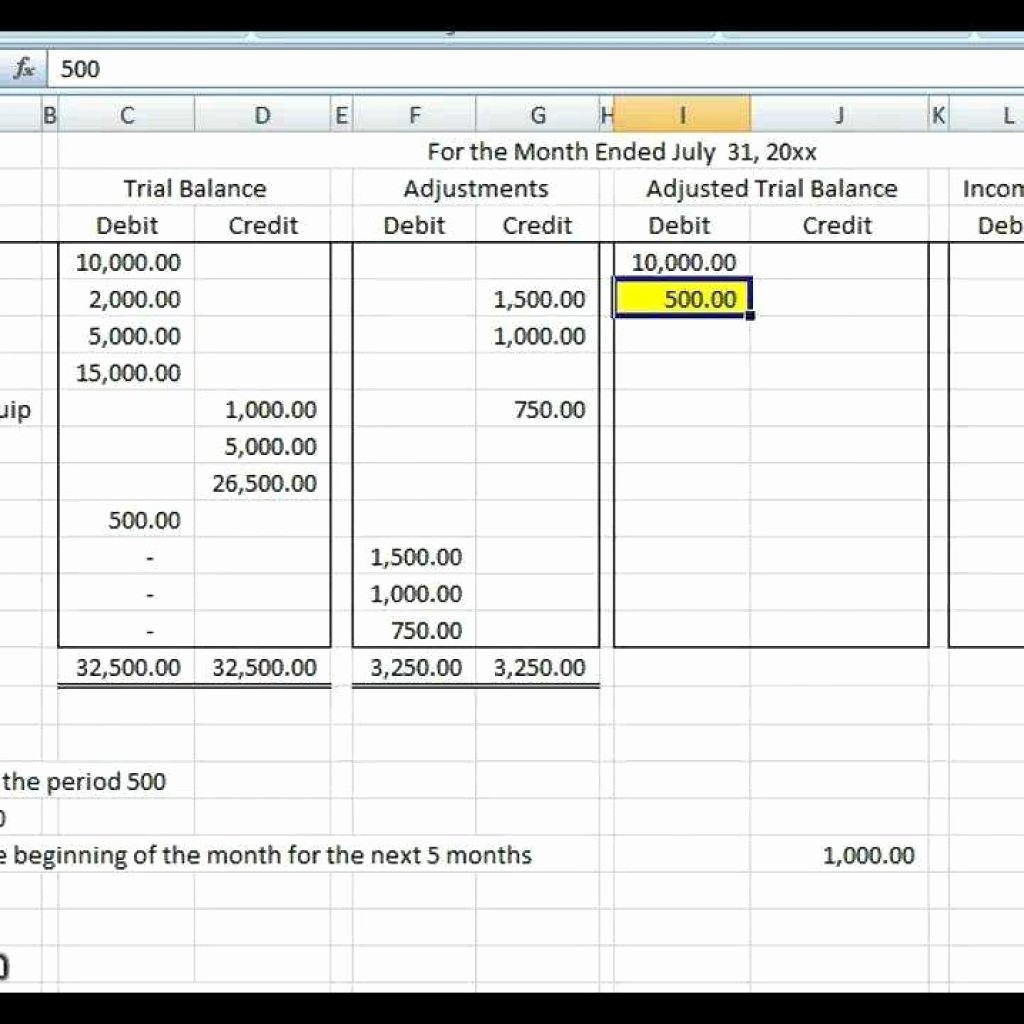

Debit credit expense account trial#

A trial balance includes all accounts from the balance sheets and profit and loss statements. Because you are accounting for all movement of funds, you get a clear picture of your financial standing.Īt any point, the total of the entries on the left side of the trial balance (debits) will equal the total of the entries on the right side (credits). With it, you record each transaction as a debit and a credit, hence the name double entry accounting.

By getting a firm grasp on the concept of debits and credits, you’ll have a leg up when it comes to completing your accounting accurately.ĭebits and credits are used in double entry accounting to ensure that everything balances out at the end of the accounting period. Most business owners understand that they need to keep track of their income and expenses but many get tripped up when figuring out what accounts are debits and credits.

0 kommentar(er)

0 kommentar(er)